College in good financial standing, finalizes 2020-21 operating budget

February 19, 2021

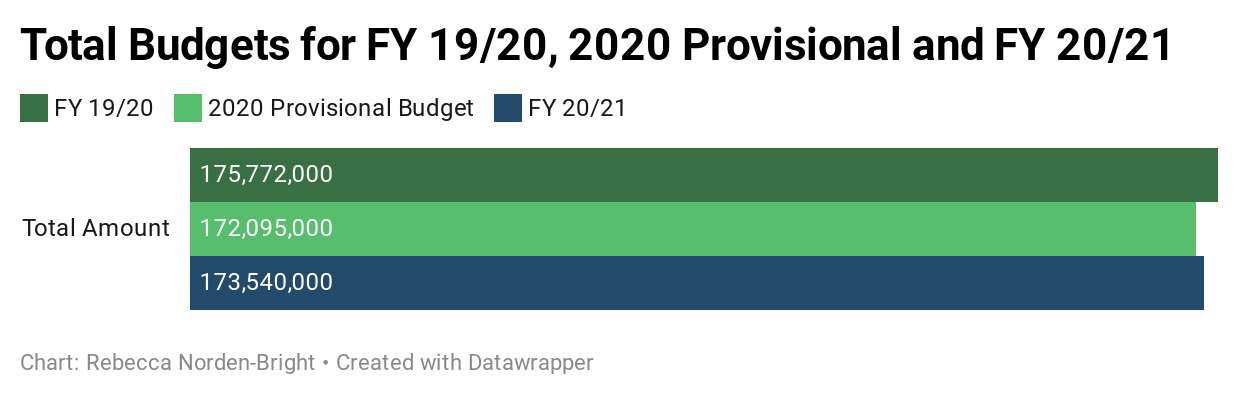

The College’s most recent operating budget for the 2020-21 fiscal year (FY) has been set at $173.54 million. The new budget, voted on during last month’s meeting of the Board of Trustees, constitutes a modest 1.27 percent reduction from the FY 2019-20 budget, but a .84 percent increase from a provisional budget passed last June.

According to Senior Vice President for Finance and Administration and Treasurer of the College Matt Orlando, the operating budget reveals that the College is in solid financial standing, despite the impact that COVID-19 has had on both revenues and spending.

Orlando’s evaluation follows an email from President Clayton Rose sent on May 15, 2020, stating: “our loss in the 2020–2021 academic year may very well exceed $20 million, or 15 percent of revenue. And it could be significantly larger.”

Despite those early fears, the financial damage so far has been just half of what Rose suggested it could be—a 7.5 percent decrease in fiscal revenues compared to the prior year, according to Orlando. While revenues are down 7.5 percent, spending has only decreased by 1.27 percent, so the remaining 6.23 percent of expenses are financed by a $10.8 million withdrawal from a reserve account held by the College.

The College’s relatively strong financial standing has allowed it to roll back some of last year’s drastic budget cuts. As of February 1, the College restored all faculty and staff salaries to their pre-COVID levels, with a three percent pay increase across the board. Additionally, on September 1 of last year, the College announced that it would be reducing employer contributions to faculty and staff retirement plans by 50 percent. After five months of reduced contributions, effective February 1, the College reinstated contributions to the full amount.

“There was a general understanding on the part of faculty and staff that there were going to have to be sacrifices on the compensation side given what we were faced with at the beginning of the year,” Orlando said in a Zoom interview with the Orient. “Once the picture became clearer … and things were better than we expected, our deficit was going to be less than we anticipated, the right thing to do was to end [those] sacrifices we were asking of our faculty and staff.”

The January 2021 budget includes a line calling for the withdrawal of $10.8 million from a separate reserves account in order to balance the budget and fund the full reinstatement of employee salaries and benefits. The operating budget reserve account currently contains about $17 million, meaning $6 million will remain in the account should the College land at a budget come the end of this fiscal year on June 30.

The June 26 provisional budget included a $13.8 million withdrawal from the same account. In the past six months, the College has been able to finance a 27.7 percent decrease in the amount pulled from this reserve account, even with the additional spending on employee salaries and benefits—another reflection of the College’s relatively strong financial standing.

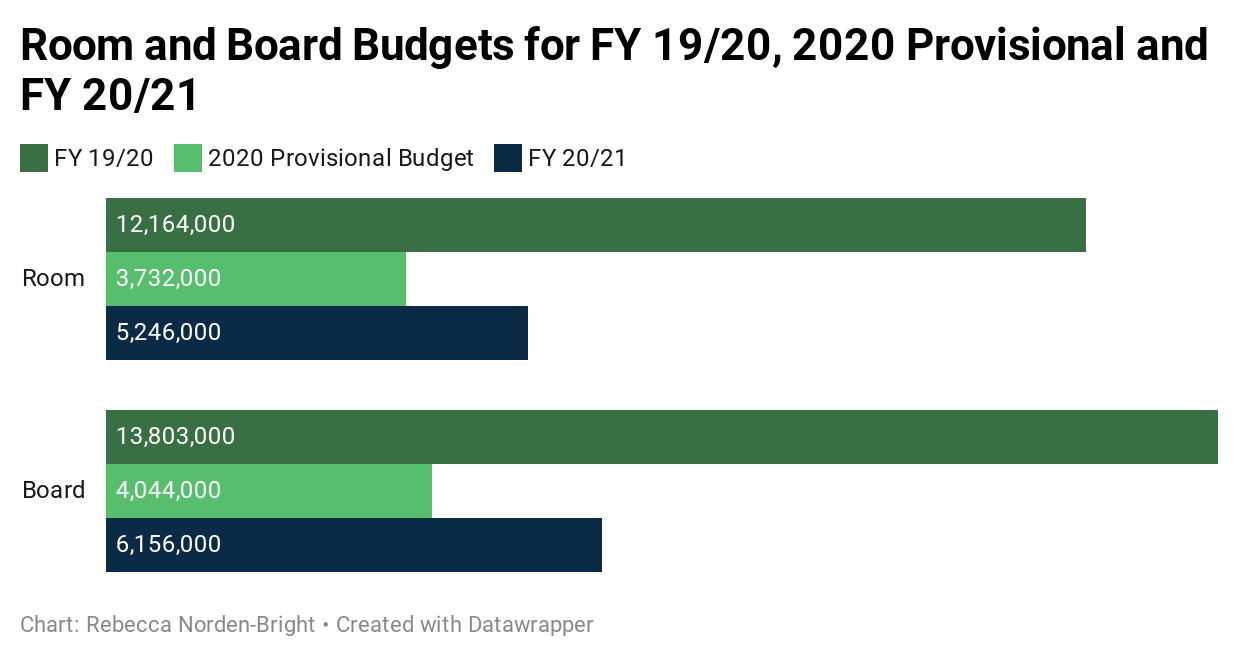

Higher-than-anticipated enrollment numbers for both semesters this year have brought in additional money from room, board and tuition payments, granting the College greater budgetary flexibility. Orlando said that the June 26 provisional budget was largely contingent on the prediction that the College would only be able to support an on-campus student population of 675 for both semesters.

“Back in June 2020, our enrollment assumption was that we could only have one class back each semester, plus a collection of other students—about 675 in residence and everyone else remote for both semesters,” Orlando said. “In the fall, we were about 100 students higher than that. And in the spring, we now have 1,013 students on campus, another 64 with on-campus privileges and 666 studying remotely. We had many fewer deferrals than we projected in May and June.”

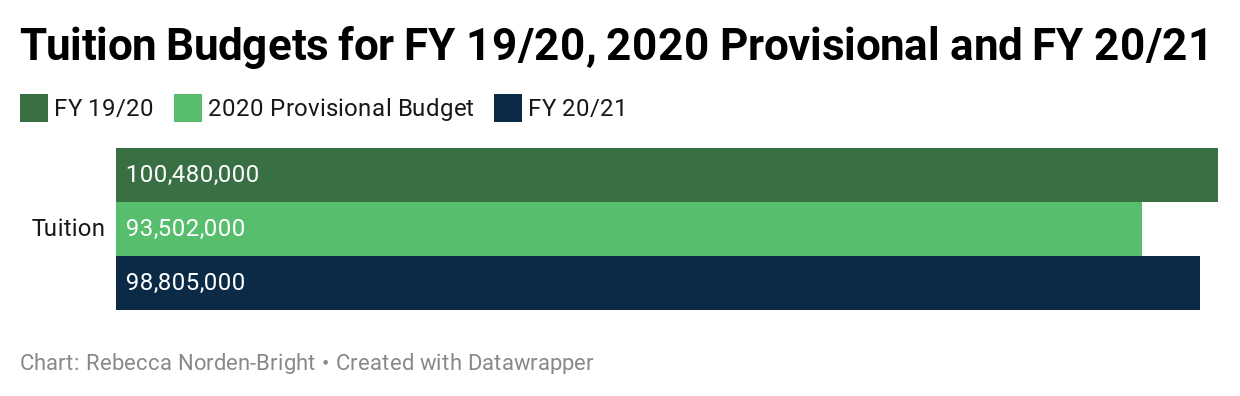

These high enrollment numbers have increased budget sources significantly—room and board income grew by 40.6 percent and 52.2 percent, respectively, from the June 2020 provisional budget to the January 2021 budget. When combined with the extra tuition collected from higher-than-expected enrollment, these totals opened up an additional $8.93 million in revenues.

Orlando said one countervailing effect of the outsized enrollment numbers was a corresponding increase in financial aid expenditures. The most recent budget includes a $4 million increase in financial aid payments from the June 26 provisional budget, a 16.7 percent hike. This is a product of the College’s decision to eliminate the work expectation for any students on aid this year in lieu of a Bowdoin grant.

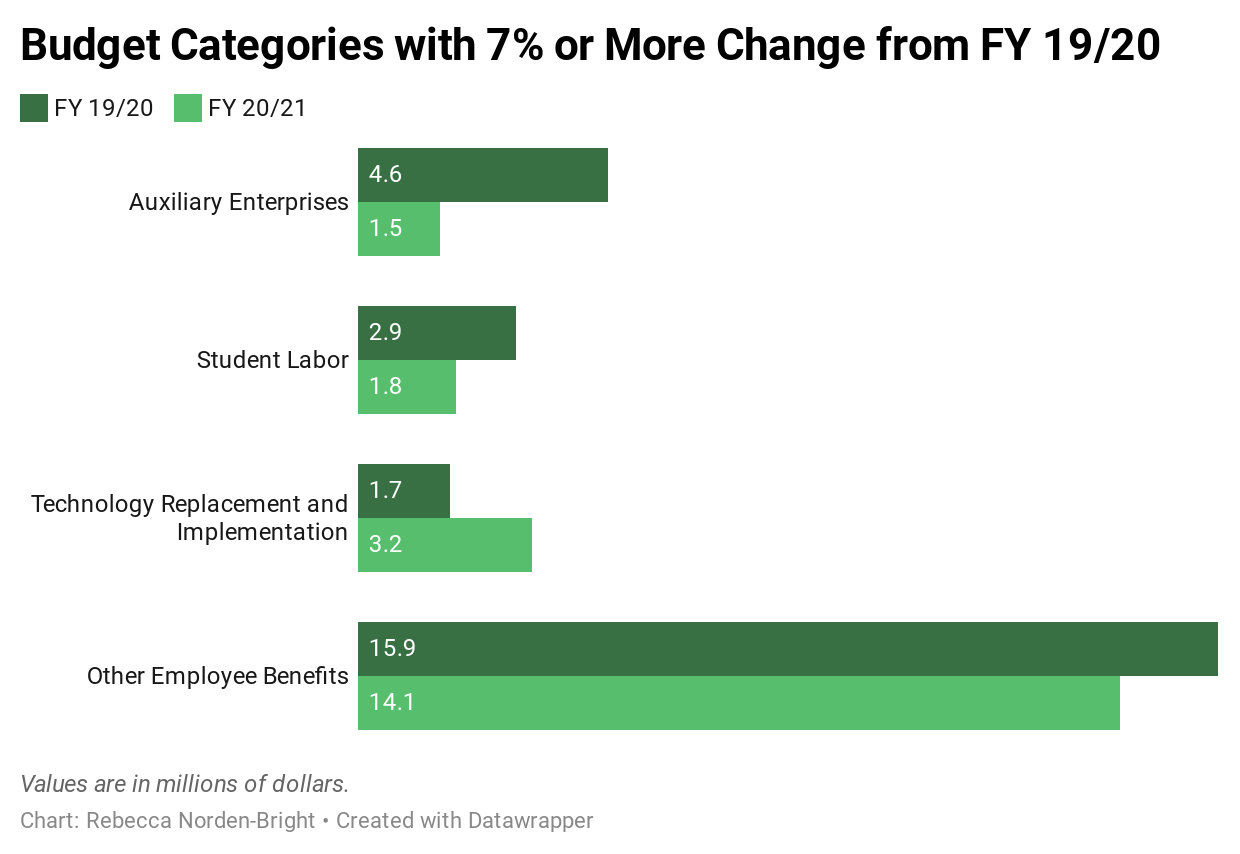

Only a few other lines in the most recent budget changed dramatically—by more than seven percent—from the FY 19/20 budget to the most recent budget. These categories were “Auxiliary Enterprises,” due to cancellations of summer camps and conferences, “Student Labor,” “Technology Replacement and Implementation” and “Other Employee Benefits.”

The lion’s share of the current operating budget comes from net tuition—47 percent, to be exact. But not far behind is endowment income, which finances 40 percent of the College’s spending. Unrestricted annual giving makes up just under six percent, with the College’s reserve account withdrawals making up the remainder.

Despite the pandemic, the success of the endowment in the booming stock market last year bodes well for the College’s future financial stability. Because the College implements a lag spending rule to dampen the effects of market volatility, changes to the endowment in 2020 will not affect its spending distribution until July 1, 2023—but even so, given the Investments Office’s recent performance, Orlando said he did not foresee any severe impacts of the pandemic on the endowment.

“We’re not through all four quarters yet, and every quarter matters … we wait until we close the books to make those kinds of forecasts. But for now, the endowment’s doing well, and we’re getting gifts, so we aren’t predicting any of those structural changes,” he said.

“I’m optimistic,” Orlando added. “There are still dark clouds ahead, particularly when you think about some of the new strains of the virus … but I’m optimistic to think that we’ll be back to somewhat normal in the fall … I feel pretty good about where we’re headed. But again, we’re not entirely through the woods yet.”

Comments

Before submitting a comment, please review our comment policy. Some key points from the policy: