Stefan Andreasson explores the many contrasts between Exxon Mobil and Europe’s oil industry

November 7, 2025

Abigail Hebert

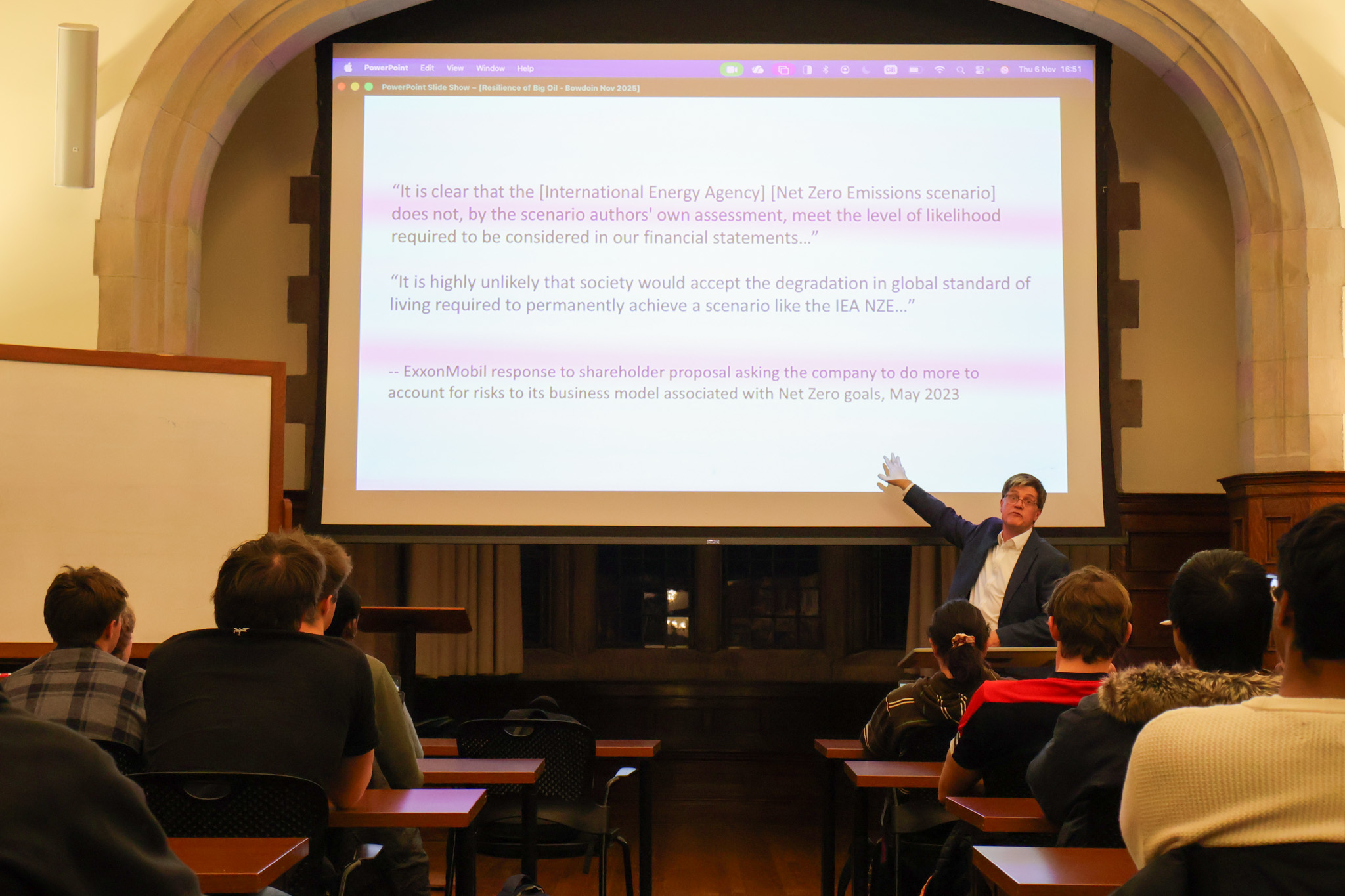

Abigail HebertOn Thursday night, Stefan Andreasson, reader in comparative politics at Queen’s University Belfast, delivered a lecture unpacking the dominance of Exxon Mobil in the American and global oil industries. Andreasson examined Exxon Mobil’s commitment to growing its oil and gas production as peer companies in Europe look to transition to renewable energy.

Andreasson classified Exxon Mobil’s approach as “contrarian,” explaining that its actions subvert the global narrative of transitioning away from fossil fuels many European oil and gas companies have participated in.

Andreasson’s explanation for this discrepancy is the United States’ “petroculture.” He dissected American culture’s reliance on and obsession with oil and gas, ranging from the relationship between drilling and private subsoil rights to how the fossil fuel industry is portrayed by Hollywood. He noted that oil and gas are not similarly socially entrenched in Europe.

“The European oil majors also got their start in the late 19th century. But where do they get the oil from? From the far-flung corners of empire,” Andreasson said.

Andreasson presented a graph showing how renewable energy use thus far has simply complemented fossil fuel use globally. Fossil fuel growth, according to the graph, has either plateaued or continued to grow—a sign that a clean energy transition has yet to meaningfully occur.

“It’s becoming, in many cases, cheaper to produce renewable energy than all of that. But it’s notoriously difficult to bring in profits, and investors don’t invest in industries and in companies because of the costs. They invest based on what they can make in profit for the future. And there’s no contest in terms of oil and gas,” Andreasson said. “Oil and gas remain key.”

Exxon Mobil, rather than joining this attempt to pivot toward renewable energy, is investing heavily in its oil and gas production, projected to grow 18 percent by 2030. Andreassen highlighted that instead of investing in the infrastructure to transition, Exxon Mobil is building out its carbon capture technology and producing blue hydrogen, which is made from reformed natural gas.

Andreasson also noted Exxon Mobil’s exploration of complementary industries; he described how Exxon Mobil is looking into joining the lithium mining industry, which uses extractive technologies similar to oil drilling. Andreasson posited that investment in these areas is a sign that Exxon Mobil is doubling down on oil and gas.

“The core of what [Exxon Mobil] does and what it will spend money on is its core physical production … and all of what they call their advantaged assets, where they think it’s going to deliver the big bucks for them in the future,” Andreasson said.

This “contrarian” investment from Exxon Mobil, Andreasson argued, differs from European companies like BP and Ørsted that have either fully or partially transitioned to renewable energy.

“The contrast is with the European oil and gas companies, who, relatively speaking, have taken a slightly more progressive approach to the energy transition, have been a little bit more willing to invest in renewable technologies, to move a little bit further towards some future notion of becoming integrated energy companies,” Andreasson said.

Following this discussion of the differences between American and European oil, Andreasson pivoted to recent legislation and regulatory changes under the Biden and Trump administrations that are conciliatory to the oil and gas industries. While he said that Trump’s “Unleashing American Energy” program more clearly unfetters the oil and gas industries, he also noted that Biden’s Inflation Reduction Act also had incentives for the oil and gas industries’ decarbonization efforts, like those pursued by Exxon Mobil.

Andreasson focused on Trump’s current administration, however, painting him as an “X factor” to nonrenewable energy policy in the United States and pointing to Trump’s new tariffs in particular.

“There are many areas of governance where uncertainty, and uncertainty with tariffs in particular, has been a huge concern for oil and gas companies in terms of their potential for slowing down global economic activities, products and so on,” Andreasson said. “[Oil and gas companies have] been quite concerned, actually, about the lack of predictability in terms of what the administration will do.”

Even with these recent fluctuations, Andreasson reiterated that companies like Exxon Mobil are primarily driven by potential profit and the energy market rather than favorable or unfavorable policies.

“At the end of the day, companies will act primarily on assumptions about future demand for future energy. It’s about supply and demand. Policies that are more or less supportive, yes, they matter, but it’s not the most important [factor],” Andreasson said.

Comments

Before submitting a comment, please review our comment policy. Some key points from the policy: