An open letter to the college: let’s talk about debt

April 24, 2020

This

piece represents the opinion of the author

.

This

piece represents the opinion of the author

.

Alex Burns

Alex BurnsDuring times of economic crisis, which we are already rapidly approaching, matters of risk and debt become ever more relevant producers of anxiety, especially with students facing uncertain job markets and weighing the return on investment of Zoom-attendance next semester. While these pandemic conditions greatly increase anxiety, for a good number of students the conditions for worry have also been slowly building over the years in large part due to staggering increases in tuition prices and the insistence that students and their families take on more and more of the associated growth-risk in the form of debt. It should be remembered that the Time of Shedding and Cold Rocks turned a debt problem into a debt crisis, from which many have yet to recover.

As the price of a college education increases, each college needs to find new and inventive ways to justify its value to the student body. It does so by investing more capital to build new facilities while hedging markets, improving the quality of student life, its ratings and so on, all of which raises the value of the college, which in turn increases its tuition. Since the average family’s asset value hasn’t increased at the same rate, this forces students to take on even more debt to underwrite the university’s accelerating valuations and capital growth. This simplified process, when you pan out, describes how U.S. debtors arrived at $1.64 trillion in student loans. The government seems to care very little about this debt, or any consumer debt really (which has reached an astronomical $13.86 trillion dollars). Of the government COVID-19 emergency relief packets delivered, barely any of it has gone to consumers, and emphatically none of it went to students.

This pattern is informed by higher demand and the diminishing value of a degree but also this country’s skewed narratives around debt that unjustly place blame on the borrowing class—which I will later get into—while valorizing the presiding investor and lender class. The College is also, as should be remembered, governed by this investor class. The president is hired to run the college as a CEO, beholden to our trustees who, despite not having financial stake in the College, still encourage its financialization and aim to grow its capital value. The endowment is managed more or less like a hedge fund with generous tax cuts (endowments are taxed at a way lower rate than other kinds of funds), incentivized to take on more risk in the markets to obtain more capital to grow the facilities to become a more valuable investment to attract more capital, and so on and on. My issue here is not with the improved quality of the College, it is that students take on the risk of these improvements.

Professor of Political Theory, Wendy Brown of UC Berkeley, argues brilliantly how the college was not always ruled by the cold, cut-and-dried market logic that has inflated the price of higher learning to unjustifiable levels. Rather, she claims that the private university developed into a situation of financialization and market governance over time, gradually removed from its previous faculty-guided and communally centered form of governance which vanished in the mid-to-late 20th century. While college food may not have been as good, college wasn’t going to bankrupt your average middle-class American and they still managed to get a worthwhile education.

Brown’s book Undoing the Demos, explains how this financialization of everything under the sun, including college, renders “the market as truth;” “Neoliberalism involves an intensification of the market as a site of ‘veridiction,’ Foucault’s coinage for the production and circulation of truths that are established, rather than foundational, but, importantly, govern.” And govern they do. Market logic, while fraudulently disguising itself as a natural, almost divine, human process, has turned everything into a portfolio to be managed, a vessel for capital accumulation: the college is a portfolio to trustees, the student is a resume-portfolio for employers, the professor is a portfolio for tenure. Even the campus itself, a collection of facilities and structures, is a collection of appreciating assets. Each becomes a locus for investment, speculation and risk, risk diversification and risk management.

There are certain narratives around debt and the ways it is constantly relegated to the private domain. We tend to publicize and admire people’s net worth, not their debt. Debts are to be taken on in private and shamefully, I might add. No one is proud to take on a student loan and you’ll certainly not find students talking about it or organizing around it. Students are embarrassed about loans the same way home-owners are shameful and silent about their mortgages. We are taught to be shameful and, therefore, silent about our class and our class-related struggles. This kind of collective, secret lack of credit and its perverse effects happen under the surface—it unites us, even if we don’t acknowledge it.

Loan-financing of higher education is so secretive that the College actually actively hides it. This is chiefly exhibited in “need-blind admissions.” Bowdoin may be need-blind in the admission process, which is good, but it also takes a need-blind and, more specifically, debt-blind approach in financial aid allocation which is, in my opinion, deeply troubling. Bowdoin, as is the case with most colleges, determines your grant eligibility on your family income and tax bracket, not your actual ability to pay. They do not consider outgoing expenses, or calculate adjusted income to the cost of living by state (100k goes much farther in Kentucky than New York, for example).

So if the grant turns out to be inadequate and you appeal, it’s your inexperienced word against theirs. As someone that has taken out loans already and will likely take out tens of thousands more, I know on a personal level that the College has not accurately assessed my family’s financial need. I know for a fact that I am not alone because of Bowdoin’s “No Loan” policy that admits, “In fact, many families opt to borrow part of their family’s contribution.” Twenty-five percent of the class of 2019 borrowed a federal loan—there is no information about what percent needed to take out private loans or how much (which are way worse than federal loans because of higher interest rates). This is really counterintuitive for an institution that very aggressively advertises a “no loan” policy, even if it means something entirely different.

The financial aid office deploys its sophisticated financial assessment of the family and the family, usually lacking in similar sophistication, is bound to bend—it’s normal, they’ll say. Everyone is in debt. Here’s a list of scholarships. Your inability to understand its sophistication is part of how the investor class blames the debtor class. Your debt is your fault; your inability to understand it, your shortfall; your inability to pay it off by attaining a comfortable salary, or by applying for and winning scholarships is a result of your laziness. Again, this is what happens when colleges become hedge funds; hedge funds are programmed to displace as much risk as possible by transferring it to the buyer—in this case, the student.

The student takes on the risk of defaulting on his loans because he speculates that the rewards in the job market are greater than the risks. The College’s job is to convince him that the risk is next-to-none so that he agrees to enter into an arrangement with the College where he takes on all the risk and the College takes on none. Based on the $1.64 trillion in student loans, I’ve concluded that colleges have maybe exaggerated their promises a little bit and it’s foolish to assume Bowdoin is not part of this puzzle.

But this is the modern debt crisis at large: the risk is ultimately always transferred to and carried by the consumer, the student, the school teacher, the homeowner, the dreamer, to the non-financial financialized individual. The rat-race is a kind of psychological warfare that the college-business initiates; if I just take out this loan, pay this bill, get that job then I can …

Nevermind what is sacrificed in the meantime. The result is always risk-managed, peace of mind deferred. The number of 50 and 40 year-olds I know still paying off student debt speaks to this modern truth. Is it worth it?

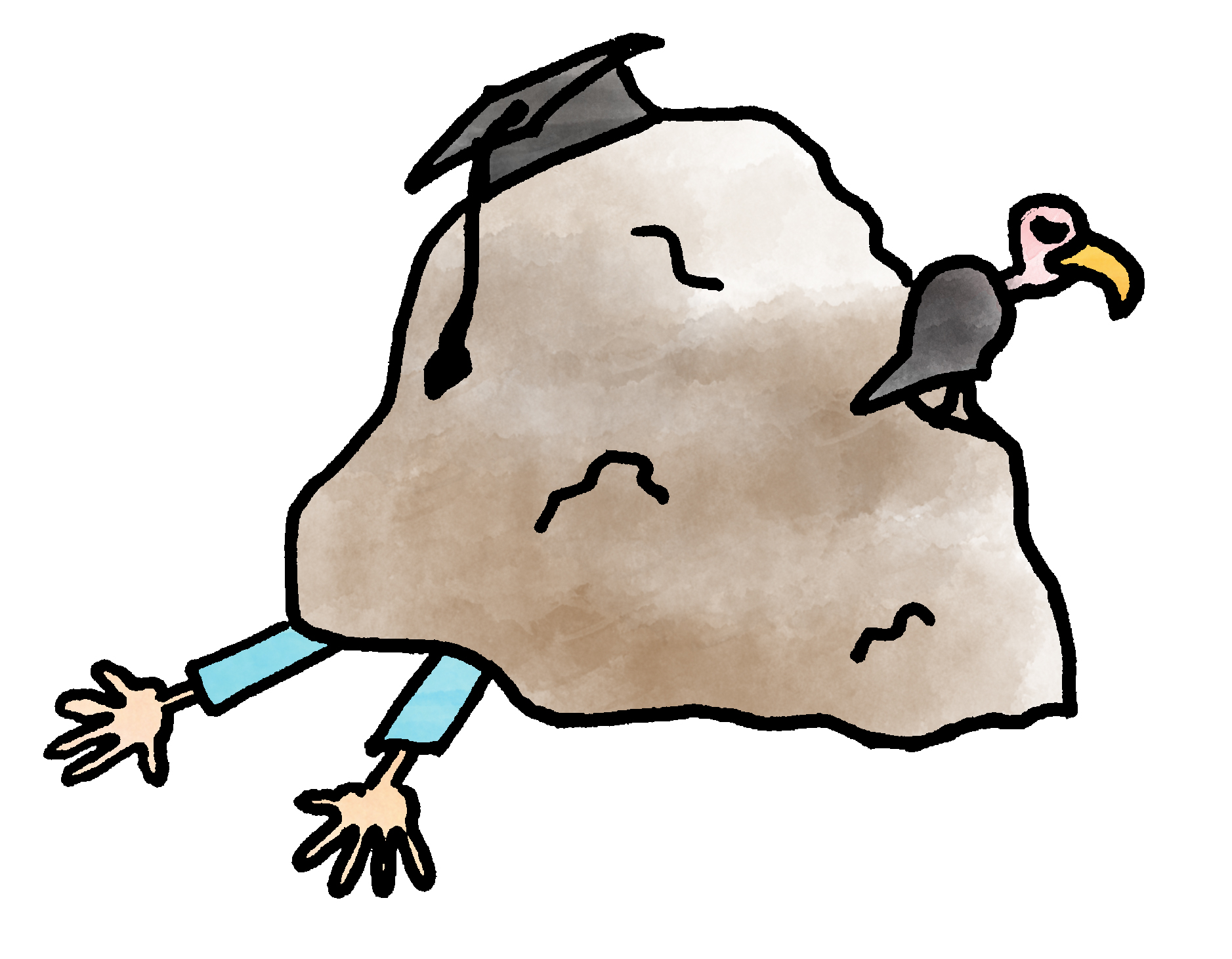

This is relevant now, more than ever. The thinly-veiled offer of the virtual college will become impossibly difficult to rationalize at the current price. How far is Bowdoin willing to go to ensure that students don’t take on more risk than necessary and aren’t gobbled up by the private lender vultures?

Comments

Before submitting a comment, please review our comment policy. Some key points from the policy:

- No hate speech, profanity, disrespectful or threatening comments.

- No personal attacks on reporters.

- Comments must be under 200 words.

- You are strongly encouraged to use a real name or identifier ("Class of '92").

- Any comments made with an email address that does not belong to you will get removed.

Best essay I’ve ever read in this paper. I am old enough to remember when Bowdoin was not governed by a cabal of policy wonks and hedge fund investors. Good financial governance should always play a major role, but higher education should not be treated as a publicly traded commodity.

Really interesting article. Another significant factor in the increase in tuition is the growth in the hiring of administrators. Unlike improvements to student life or instruction, students see little to no benefit from this administrative glut. This paper covered the rise in the number last year — administrators now outnumber professors! The core issue is that administrators are themselves in charge of hiring other administrators, while students are the ones who end up picking up the tab. As far as I can tell, many of these admins do little besides meet with each other to discuss frivolous issues that certainly do not warrant the attention of several employees with high 5 to 6 figure salaries.

Incredible essay Jared. Especially cogent reading of Wendy Brown, who is intensely sensitive to the unique pressures on academics who in some way wish to resist the oppressive market logic by which they are evaluated and which their work (as it contributes to the university-as-capital-pile) ultimately serves. Consider Foucault’s work on “The Courage of Truth” as it pertains to the task of the genuinely radical thinker in the contemporary university.