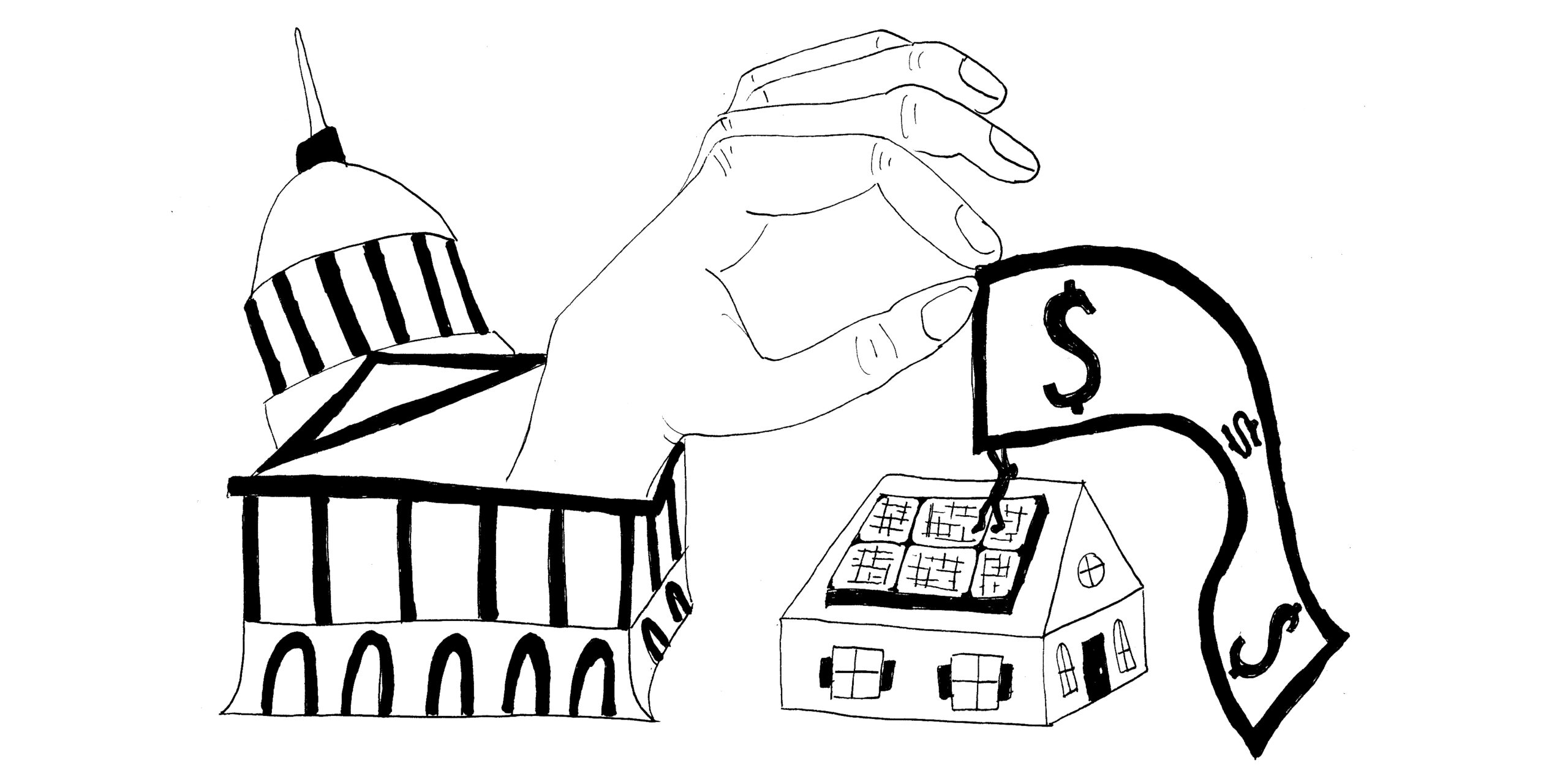

Don’t block the sun: stop taxing solar panels

May 4, 2018

This

piece represents the opinion of the author

.

This

piece represents the opinion of the author

.

Ben Franklin said nothing is certain in life except death and taxes. If I had to state a preference, I’d say death is better, because it only happens once and makes more sense.

I’m generally accepting of taxes because we need to finance and maintain quality roads, police and fire protection, schools and other shared services.

However, taxes can go too far, as they have in Brunswick. The Town of Brunswick’s Assessing Department recently levied a property tax on solar panels that make electricity, an unwelcome surprise to the 130 households in town with solar—as if life isn’t tough enough with long, cold, ice-laden winters alleviated finally by spring and the fear of lethal tick bites.

The central issue is whether solar energy increases home resale values. But the decision to tax is premature at best because it’s based on a loose assumption devoid of relevant data on the direction and magnitude of a possible price effect.

Solar homeowners who are appealing the decision must show that the Assessing Department has been “arbitrary and capricious.” This feels disagreeably harsh. Couldn’t we just say that it was a simple mistake, drop the tax and be neighborly?

Webster’s definition for arbitrary is “depending on individual discretion and not fixed by law.” The definition fits the situation here pretty well because the solar tax originated from an undocumented internet search and because tax assessors elsewhere, including Freeport and Kittery, believe the evidence doesn’t justify solar assessments.

Following the initial public outcry, the Assessing Department lowered its solar valuations from $500 per panel to $235 per panel. While that’s an improvement, by my calculation, it’s only $265 less arbitrary.

This coming tax year, the Assessing Department is replacing the per panel methodology with an online computer model that considers system performance and depreciation. That’s because income from solar varies according to the size, model and age of the panels, system orientation, inverters, warranties and utility rates. In self-testing the model, I found it easy to use but disconcerting in its failure to account for shading, snow cover and other factors.

And there’s a catch. Homeowners will be required to self-report by filling out a technical questionnaire on their system—cheese for the new electronic mousetrap. Yet, the real question remains—are there any mice? In other words, do homebuyers care one whit about solar, enough to pay a premium for it? The evidence isn’t there.

Solar certainly wasn’t on our wish list when my wife and I were contemplating a move to Maine years ago. We liked the Midcoast area and what Brunswick offered. Our housing interests centered around rooms, especially a nice guest room to entice our far-flung friends and relatives to visit. If a prospective house had solar, its aesthetics or potential repairs might have concerned us.

Besides arbitrary, the solar tax isn’t fair. Many other energy investments save money, such as insulation, LEDs, thermal windows, energy-saving appliances and high-efficiency replacement boilers, not to mention wood stoves, pellet stoves and natural gas. They’re not self-reported for savings and performance. And it’s not clear about heat pumps, backup generators and related solar hot water systems.

At a minimum, the Assessing Department should declare a moratorium to investigate the issues and devise consistent rates for all energy-saving measures, not just the ones most visible from the street.

Solar investments are risky enough. In our case, we’ll have to defy the actuarial tables and live another 12 years to break even on our seven-year-old system. But it’s not all about the money; it’s about doing our small part for the environment and cleaner air.

With a tax on solar, “beautifully balanced” Brunswick is like a listing ship. A solar tax belies environmental planning and is horrible economics. We shouldn’t be penalizing investments in clean energy but encouraging them, similar to exemptions that Bowdoin and Brunswick Landing receive for their solar installations. Solar investments create business opportunities, support work for installers and electricians and increase competition to keep energy prices down for everyone.

If our Assessing Department can’t get it right, the answer is for the state Legislature to ban this type of tax, like 25 other states have done. Three other states, including New Hampshire, have granted a “local option” to elected town officials, thereby recognizing the right of citizens to have a say into how they’re taxed. The Boston Tea Party comes to mind—but throwing our solar panels into the Androscoggin in protest wouldn’t be good environmentally.

Jake Plante is a Brunswick resident and author of the book “Uncle Sam and Mother Earth: Shaping the Nation’s Environmental Path.”

Comments

Before submitting a comment, please review our comment policy. Some key points from the policy: