The carbon tax debate: A path to bipartisan climate action

January 24, 2025

This

piece represents the opinion of the author

s.

This

piece represents the opinion of the author

s.

Eva Ahn

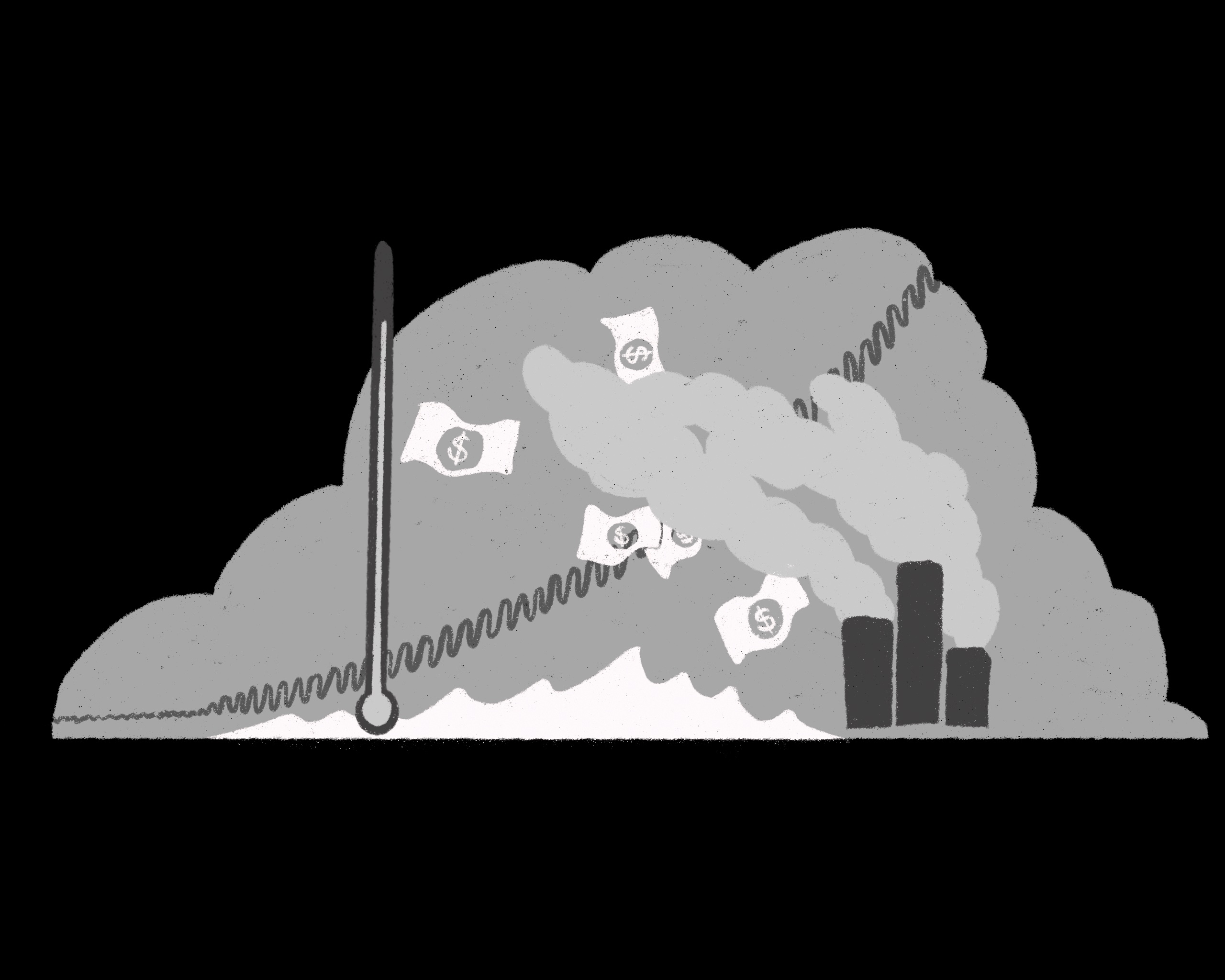

Eva AhnIf we were to imagine a policy that not only reduces carbon emissions and stimulates the economy but also unites arguably the largest and most noticeable divide in the U.S.—the polarization between the Republican and Democratic Parties—we wouldn’t be dreaming. These are the promises of a well-designed carbon tax. Implementing a carbon tax could help bridge the partisan divide in the U.S., because it aligns with conservative and liberal priorities alike—it would incentivize a reduction in carbon emissions due to the promise of increased economic efficiency while generating government revenue for social redistribution.

While the environmental upsides of a carbon tax are self-explanatory, it’s important to view this policy beyond the scope of climate change.

MIT Sloan professor Deborah Lucas and Barclays head of research Jeff Meli approached this topic from an economic standpoint, discussing some of the different arguments for a carbon tax and highlighting its main economic benefits. Looking at this from a more technical point of view, we can acknowledge that greenhouse gases are, in economic terms, a negative externality. Even though it’s only certain individuals or companies responsible for the exceedingly high carbon emissions, it’s society as a whole that endures the costs associated with them.

A carbon tax would essentially help internalize this externality, making it so that the burden of carbon emissions would be mostly carried by the emitters of greenhouse gases. In other words, by making large emitters pay for the societal costs of their emissions via a carbon tax, the total cost to society would be reduced, because these emitters would become financially incentivized to reduce their carbon footprint in the most cost-efficient way. This aligns with the concept of economic efficiency, where the goal is to achieve a desired outcome—reducing carbon emissions—at the lowest possible cost to society.

Some states in the U.S. have already implemented so-called carbon pricing policies, which are less “aggressive” and more complex ways of charging companies and individuals for emitting carbon. These states, including California, Washington and the eleven Northeast states that comprise the Regional Greenhouse Gas Initiative (RGGI), have made excellent progress in making high carbon emitters more responsible for their societal costs.

However, these carbon pricing policies are often just cap-and-trade programs that, instead of setting a price on carbon emissions, issue a number of emissions “allowances” per year. This is not the most effective option to lower carbon emissions—the lack of a definitive and consistent monetary consequence allows firms to be more flexible in their emissions cuts. Also, if the emissions cap is set too high to accommodate larger emitters, smaller firms may view it as a “free pass” to increase their emissions.

By passing a carbon tax bill and implementing it at the federal level, policymakers could avoid the pitfalls of overgenerous emissions caps and ensure that all emitters face the same cost per ton of CO2.

In order to implement a successful carbon tax, it’s important to analyze an existing, successful one. Sweden has demonstrated remarkable efficiency with its carbon tax, which was introduced in 1991 at a rate of around $26 per ton of CO2, having incrementally increased to approximately $131 by 2024. This gradual implementation gave households and businesses time to adapt, improving the political feasibility of the policy. Focused on fossil fuels, this tax was simple to introduce since it leverages existing excise systems and measures carbon content rather than emissions. This tax, covering over 95 percent of Sweden’s fossil carbon emissions, incentivizes energy efficiency and renewable energy use while generating significant revenue for the country’s general budget, showcasing a balanced and adaptable model that could be applied to the U.S.’s climate policy framework.

Despite this example, there are a few reasons why there is opposition to carbon taxes, the main one centering around the fact that it could constitute a regressive policy. It’s important to acknowledge the truth behind this statement—a carbon tax would cause an increase in the cost of carbon-intensive goods and services, from electricity to gasoline, which would disproportionately affect low-income households. These households would pay a larger portion of their limited income towards this tax, which would only exacerbate financial inequality. However, it would be possible to mitigate this by using some of the government revenue raised by the carbon tax to set up direct payments to low-income Americans, leaving everyone better off post-tax.

This solution would imply the creation of a sort of tax-rebate bracket so that financially disadvantaged households wouldn’t be negatively affected by this tax: Each low-income individual or home would receive a certain percentage of the raised revenue.

The fact is that global temperatures are now higher than at any other time in recorded history—2023 saw a global surface temperature of approximately 1.18 degrees Celsius higher than the average in 1880. People, property, the environment and the global economy will become increasingly endangered, and losses, physical or not, will rise alongside the number of “natural” disasters.

We can therefore view this concern as a nonpartisan one—both social and economic impacts will be heavily felt across the U.S. if the government doesn’t come together to approve this policy. This “political tool” could not only help slow the effects of climate change but also contribute to the country’s long-term fiscal and economic health, all while helping bridge the gap that is the partisan divide.

Will Childs is a member of the Class of 2028 and Nico Schermer is a member of the Class of 2027.

Comments

Before submitting a comment, please review our comment policy. Some key points from the policy: